Selecting an Interest Rate

It’s Wise to Understand the Options

Asking your lender what is your interest rate, colloquially known as the price of your money, is a lot like asking your car dealer what is the price of cars.

Just as cars come in a multitude of makes and models, interest rate products come in a vast array of attributes. Knowing which interest rate product is right for you requires that you ask yourself a series of questions.

Before we look at the questions, however, there is one fundamental aspect of the cost of money that must be understood: the longer you want the money at a certain price, generally the more expensive it is. In other words, if the price of money to be repaid over 10 years is 5% then the cost for 15 years might be something in the order of 7%. Just like when a bank borrows your money with a Certificate of Deposit (CD) they pay 1.5% for 3 years and 2.25% for 5 years. In essence they have to pay you a higher rate for you to lend them the money longer.

What ultimately drives this difference? Money is a commodity just like farm commodities and it is traded every day around the world. Depending on the supply and demand of money over the range of timeframes determines what the cost is on a daily basis. And just like farm commodities you can hedge the cost of money and contract the price so that it will not change.

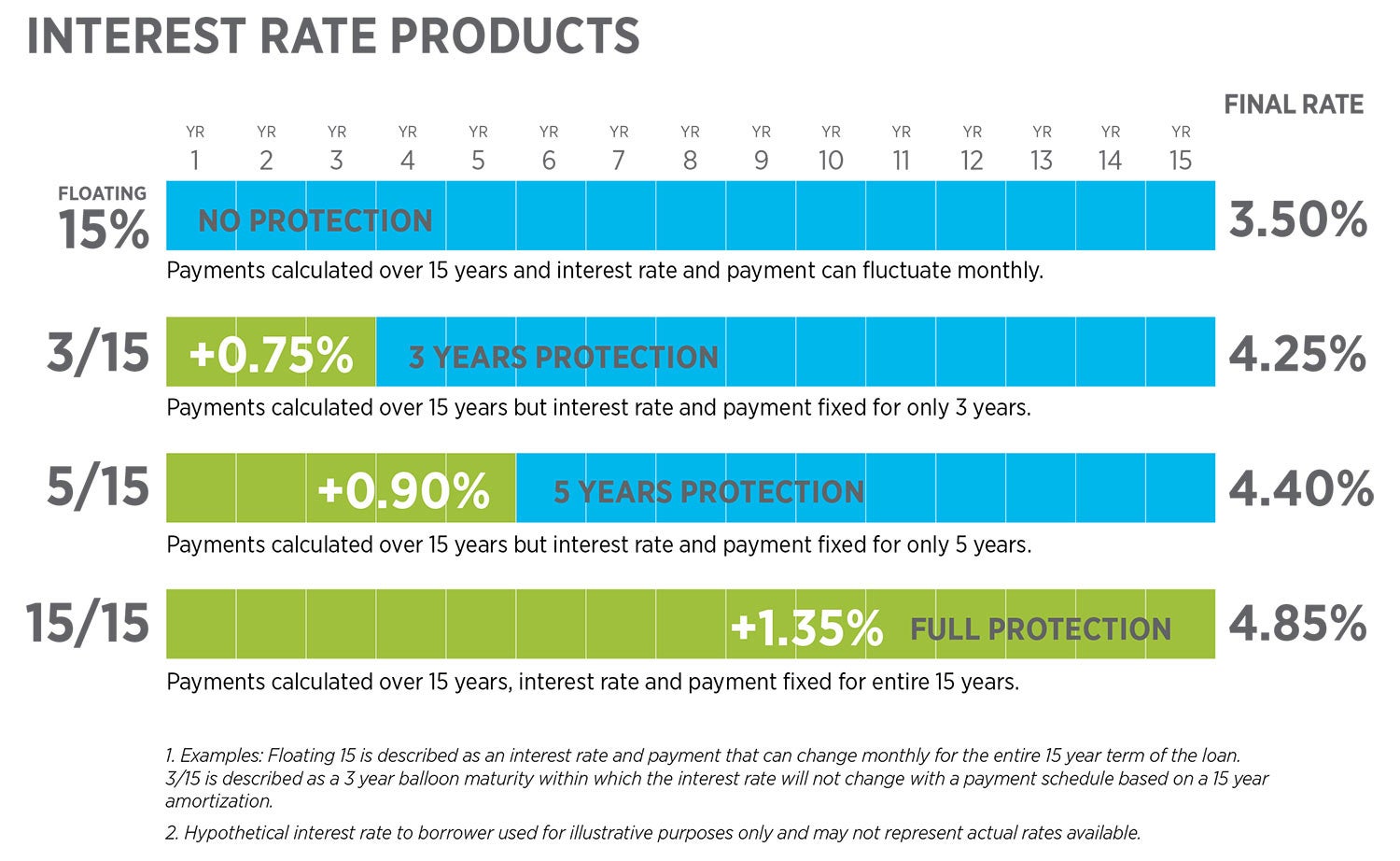

To illustrate how one can determine the degree they wish to remove uncertainty from their cost of money look at the example shown.

As portrayed in the table for a range of interest rate product structures, it is apparent that as you move further out in time (3, 5, and 15 year maturities) the interest rate rises. Whenever the actual maturity is less than the scheduled amortization, it is called a balloon maturity and the entire loan is due and payable at that time. More often than not the loan is renewed, but it is done so at whatever the prevailing interest rate is at the time. Another way of looking at this is on an incremental basis, viewing the difference in the money cost that can change monthly, over that which will not change over set periods of time. So the first question you need to ask yourself is how much protection you really want. The basic concept is that the floating rate would have to rise above the fixed rate greater than the cost differential for more than half of the term to maturity for the protection of the fixed rate to be less cost.

During the low interest rate environment we have experienced for the last 8 years it would appear that a floating rate was the best choice. A better way of looking at the issue is more like an insurance contract. Insurance is generally obtained to prevent catastrophic loss from things we cannot predict and that would have disastrous consequences to your financial circumstances. And because no one can predict changes in interest rates, especially drastic changes, the cost of protection is really just insurance for what you can’t afford to have happen. The more apt you are to be able to afford interest rate rises the less you need insurance, even though you still might want it.

Another question one might ask, is term to maturity the only thing that affects the cost of money? No there are other factors involved as well, such as financial capacity of the applicant, whether the repayment is monthly, quarterly or annually and whether the payment structure is a standard equal payment or other payment structure. Generally these factors do not affect the rate as much as term to maturity does.

One thing we see occasionally is when folks get confused or even possibly misled as to the actual structure of the interest rate product. Comparing the price of a 3 year balloon product with that of a fully amortized product is not comparing apples to apples. The fully amortized product in the example above, costs .60% more than the 3 year balloon product (4.85% vs 4.25%). What is often lost sight of is the fact that in 3 years the loan must be renewed at additional fees and whatever interest rate is prevalent in the market at the time. Consequently, just because you have been quoted a lower price it does not mean it is the better deal as it actually depends on a number of factors.

The more you know, the better your conversation with your lender.